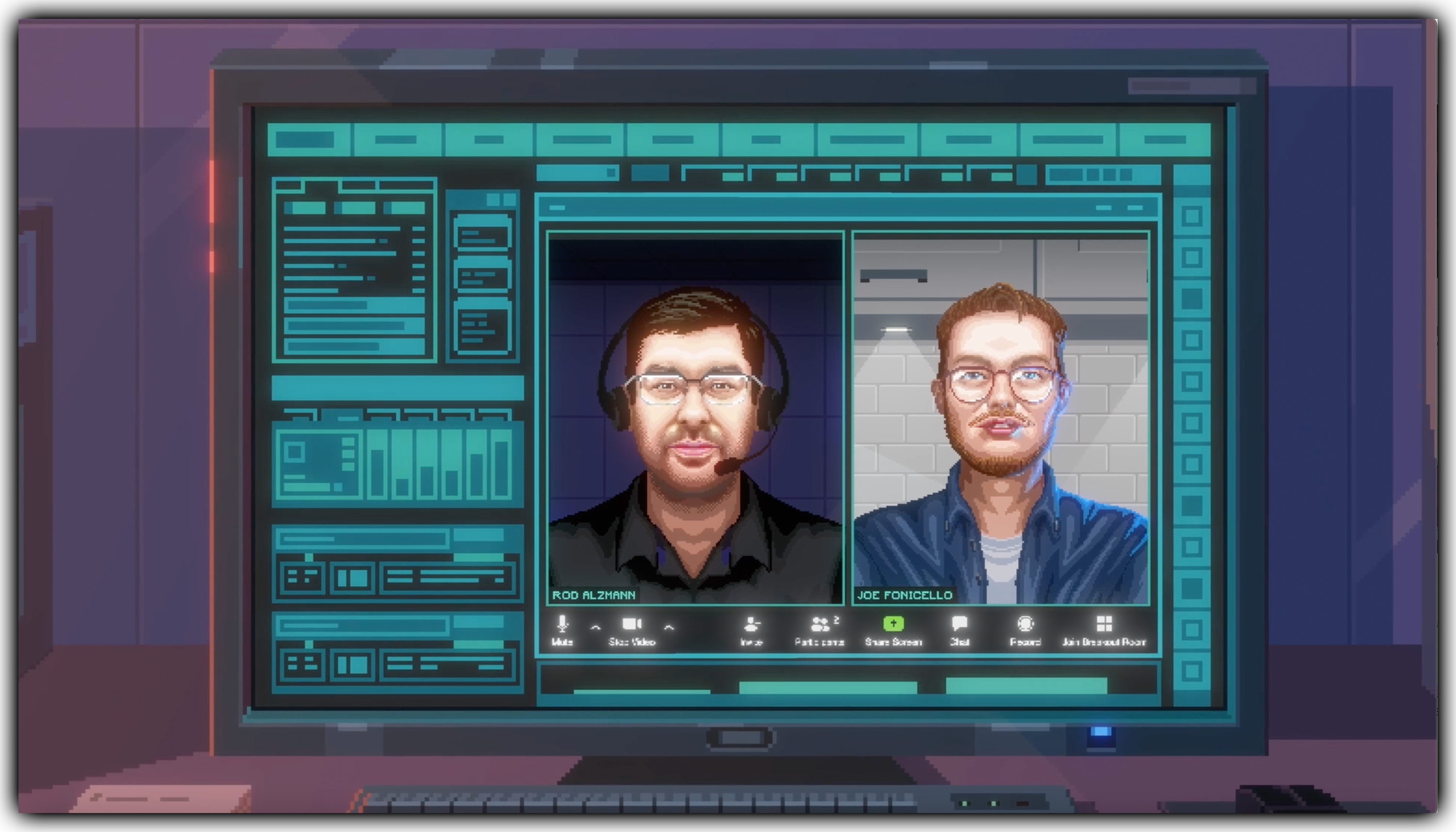

Rod Alzmann and Joe Fonicello of GMEdd․com collaborated with acclaimed director Jonah Tulis to share the story of the foundation of GMEdd.com alongside the stock market frenzy surrounding GameStop shares.

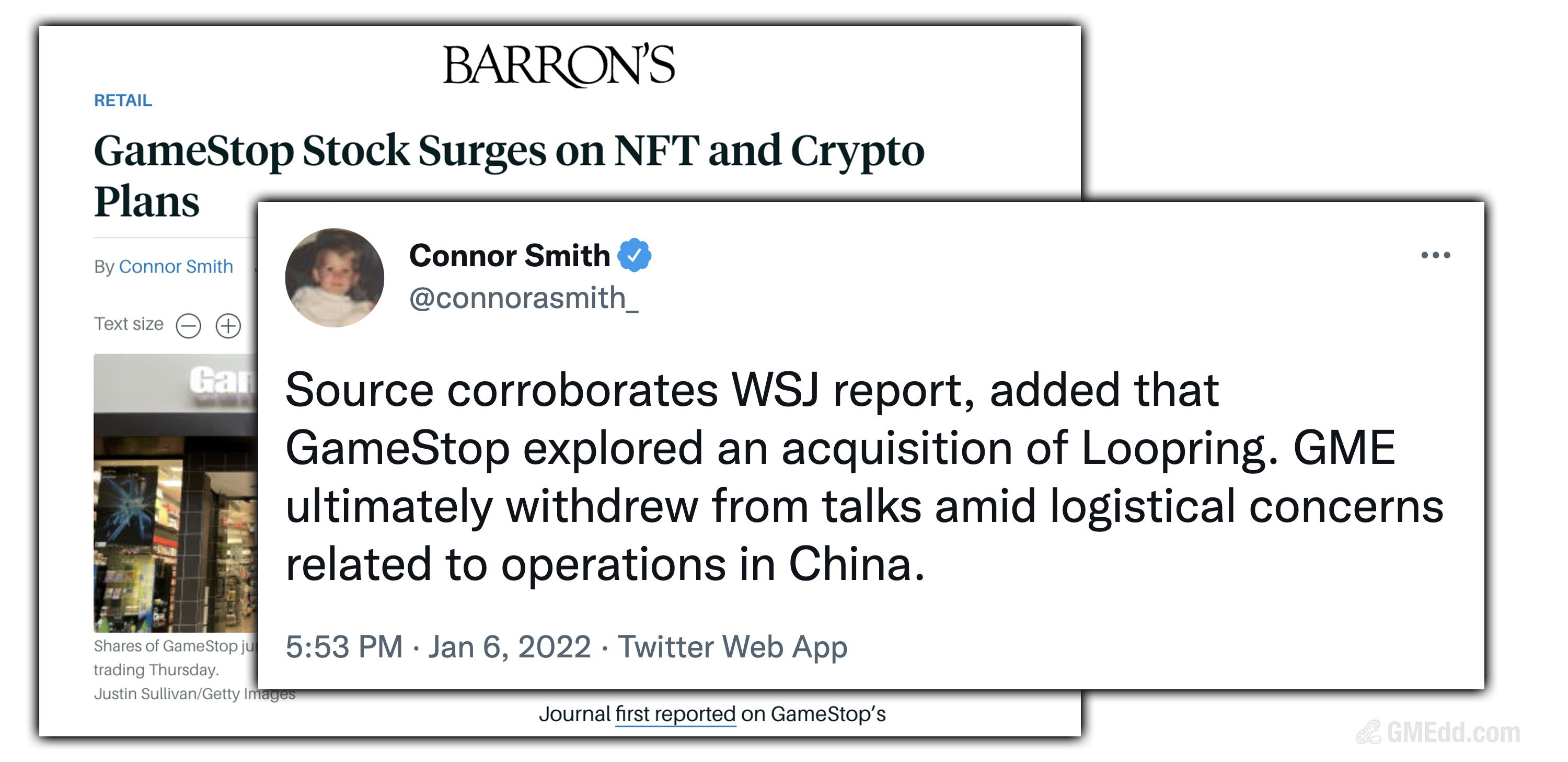

In January 2021, video game retailer GameStop had been the top story on every news network in the world. GameStop’s shares had risen over 2,500% amidst a wild flurry of volatility, netting enormous gains to investors and costing short sellers billions in the process.

But this wasn’t the whole story. The frenzy was the result of a battle that has been brewing for years; a chronicle of a band of contrarians who resisted conventional wisdom to bet on their own research, on a business that Wall Street had given up on.

Tulis states, “I talked to anyone and everyone and soon discovered there was a group of people who had been in on GameStop since early-2019, when the stock was in the low single digits. Not only that, these people all met online and sort of became a makeshift investors club.”

The feature is told like a “campfire story,” by the people who lived it, in the moment, with no narrators or pundits giving a basic overview.

GAMESTOP: RISE OF THE PLAYERS will feature familiar faces to dedicated retail investors in the stock, including but not limited to, Justin Dopierala, Farris Husseini, Rod Alzmann, and Joe Fonicello.

By day, Rod Alzmann worked as a corporate strategist for a Fortune 500 transportation & logistics company; and by night he served as the unofficial “Chief Strategist for a contrarian crew of GameStop investors,” per film producer Blake Harris. After years of pulling from a seemingly endless bag of unorthodox ideas, Alzmann would eventually become the “face” of GameStop’s army of retail investors, as a staple on Bloomberg and other financial programming.

Joe Fonicello attended the University of Connecticut and with an uncertain future awaiting him—made even more uncertain when COVID hits—Fonicello decides to travel the country in a Sprinter van and finish his senior year remotely. Along the way, he discovers the “GameStop thesis” and his life changes forever, as he begins digging deep into the retailer and spreading the word via social media, joining forces with Rod Alzmann to turn GMEdd.com into the ultimate one-stop-shop for crowd-sourced due diligence on Wall Street’s anti-darling.

The documentary will also feature Dmitriy Kozin, Farris Husseini, Jenn Kruza, Tom Barton, Jeff Tarzia, Abbe Minor, Justin Dopierala, Rigoberto Alcaraz, and infamous short seller Andrew Left.

GAMESTOP: RISE OF THE PLAYERS arrives in theatres on January 28th, 2022. For tickets and availability, visit Fandago.com.

While GameStop’s evolution into a digital-first technology company is only beginning, the prologue is worth understanding, and we believe the documentary works to paint a truthful and entertaining picture.

As a disclaimer, Rod Alzmann and Joe Fonicello of GMEdd.com volunteered their time to be interviewed for this project, to ensure the factual story was told and represented fairly. Thank you to all of our readers for supporting us.