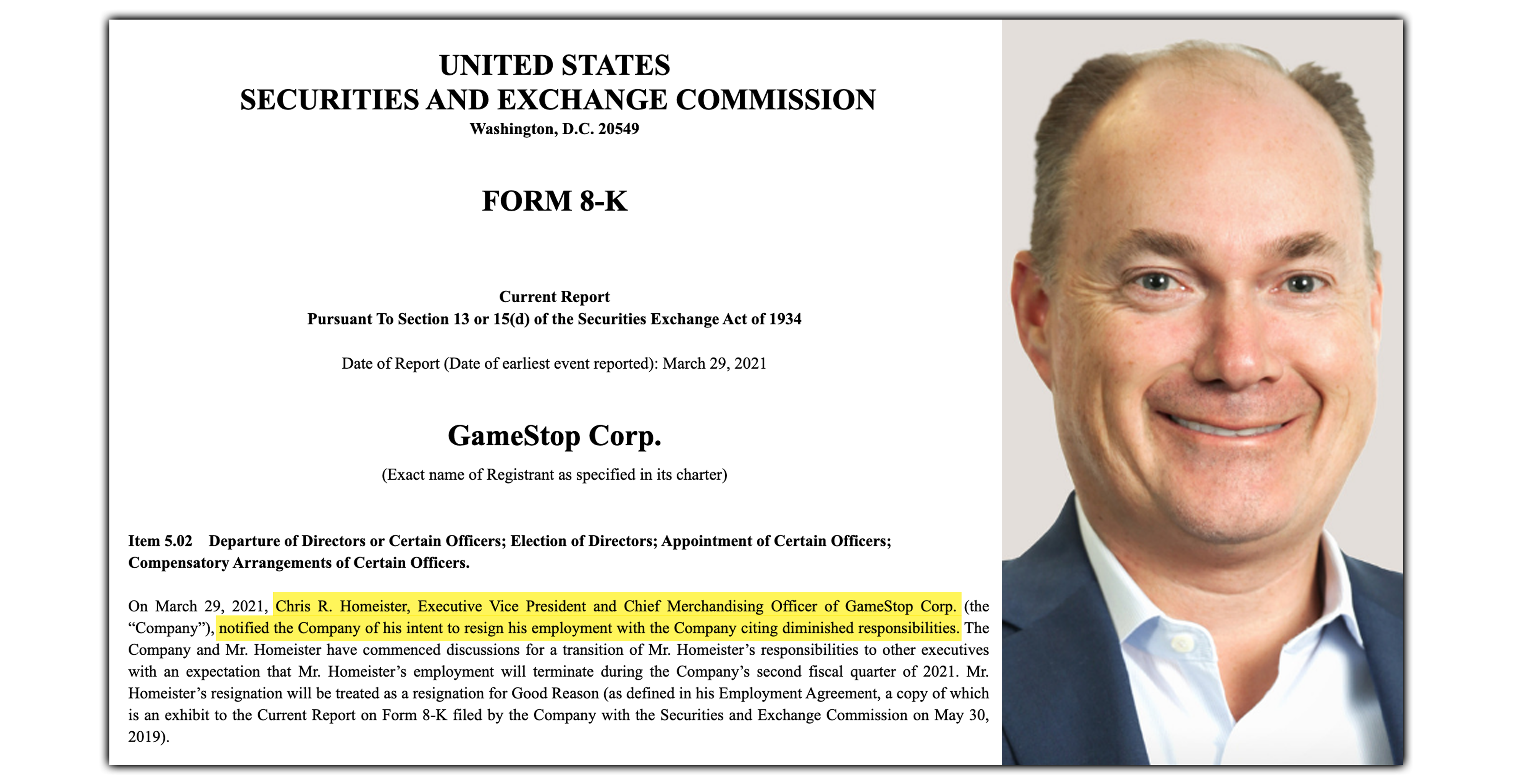

The executive overhaul continues as revealed today in a SEC Form 8-K Filing, GameStop’s Chief Merchandising Officer has notified the company of his intent to resign.

Chris R. Homeister had served as Executive Vice President and Chief Merchandising Officer for GameStop, a role he was appointed to in June of 2019.

As Chief Merchandising Officer, Chris was responsible for GameStop’s overall merchandise operations and strategy and all product and visual merchandising functions, including buying, planning, supply chain and logistics, and inventory control efforts.

Prior to joining GameStop, Chris served as President, CEO and a member of the Board of Directors of The Tile Shop, a publicly traded specialty retailer, where he grew the company in terms of product assortment, online and mobile capabilities, store count, employees, revenue and EBITDA.

Earlier in his career, Chris held a number of senior roles at Best Buy, including SVP, Digital Merchandising & Strategic Planning and General Manager and SVP, Entertainment Business Group, where he oversaw the product categories including video games, movies, music, and eReaders and launched Best Buys’ video game trade-in business.

Chris cited diminished responsibilities as the reason for requesting resignation. His employment will be terminated during Q2 2021.

Source: GameStop Corp. SEC Filing