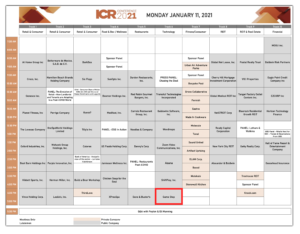

The ICR Conference is an annual event where public and private company management teams, institutional investors, sell-side research analysts, investment bankers, private equity professionals and select media connect with one another with the goal of understanding consumer trends and public company prospects as the year begins.

GameStop was scheduled to present on the last day of the ICR Conference on January 13th, under the retail category. GameStop analyst Justin Doperiala at DOMO Capital caught this minor, yet massive tweak. At some point in the last few days, GameStop was shifted from the Retail & Consumer category on the 13th to now present under the Technology category, after-hours, on January 11th. What does this mean? Management may not be so incompetent after all. They clearly requested the category switch and have something TECHNOLOGY related to share. M&A? Strategic shift/review? DIGITAL FIRST OMNI-CHANNEL?!? Who knows.

At some point in the last few days, GameStop was shifted from the Retail & Consumer category on the 13th to now present under the Technology category, after-hours, on January 11th. What does this mean? Management may not be so incompetent after all. They clearly requested the category switch and have something TECHNOLOGY related to share. M&A? Strategic shift/review? DIGITAL FIRST OMNI-CHANNEL?!? Who knows.

We’ll be tuning in and sharing what catalysts may ensue.