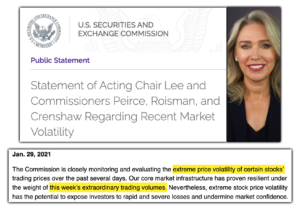

In an unexpected turn of events within a sea of unexpected events, the SEC has issued a statement that appears to side with retail investors, condoning platforms that “unduly inhibit their [investors] ability to trade certain securities.”

The Commission will closely review actions taken by regulated entities that may disadvantage investors or otherwise unduly inhibit their ability to trade certain securities.

The SEC also states that they will “act to protect retail investors,” which alleviates some concerns that trading of GameStop Corp. was on the brink of a 10-day trading halt.

In addition, we will act to protect retail investors when the facts demonstrate abusive or manipulative trading activity that is prohibited by the federal securities laws.