Yesterday, we covered Ryan Cohen‘s mysterious following of Roaring Kitty, the beloved $GME investor icon. Since our post, Cohen has unfollowed Roaring Kitty, along with The Wall Street Journal and Financial Times.

We hate to sound like gossipers, but the new follows are intriguing and worth keeping track of.

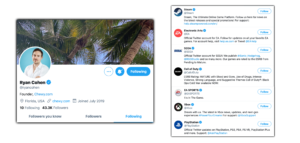

On February 3rd, GameStop hired Matt Francis, Amazon Web Services’ engineering lead, for a newly created Chief Technology Officer position. The following day, Ryan Cohen follows Steam, Electronic Arts, SEGA, Call of Duty, EA Sports, Xbox, and PlayStation on Twitter.

On October 8th, 2020, GameStop announced a strategic partnership with Microsoft/Xbox . Is it possible that there is a tech partnership with one of these companies in the works as well? We’re not sure.

We know that Cohen has been silent throughout all of the recent price action, and that he could be using his following as a way to communicate with his base.

Let us know what you think in the comments.