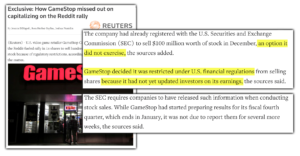

Looks like the cats out of the bag on this one. Undisclosed sources have shared with Reuters exclusively that GameStop was unable to capitalize on the recent price action by deploying the $100M shelf offering that was unveiled at Q3 earnings. Given that the offering was capped at $100 million, it would be beneficial to offer it when the market cap was so uniquely high, as it would result in less shares being released to the market, therefore diluting existing shareholders by immensely less.

While the possibility for the board to add 10% more shares to the market had frightened investors at Q3 earnings, there was a general consensus among us long investors that raising a practically free $100M to fund growth at $300 to $500/share would have been a bullish move.

Unfortunately, the SEC requires that earnings be published at the time the offering is deployed, so it is possible that this offering will not be exercised until Q4 earnings expected in March, if at all. Despite Sherman stating that utilizing the offering is unlikely, it could be used to raise money for the omnichannel transition, where a roadmap could be laid out as well.

To be clear, the source is unknown so this news is not fact, but it is still worth discussing.

Source