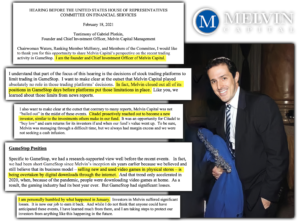

Gabe Plotkin of Melvin Capital’s testimony for the “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide,” taking place Feb. 18 at 12 p.m. ET. has been released.

Gabe Plotkin of Melvin Capital’s testimony for the “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide,” taking place Feb. 18 at 12 p.m. ET. has been released.

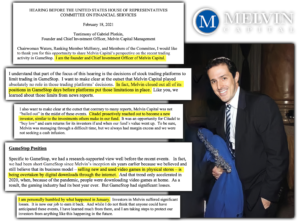

Plotkin begins his testimony by stating that has been “humbled” by the unprecedented events, as many investors “on all sides” have experienced losses.

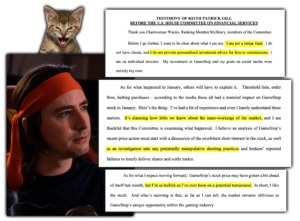

I am humbled by these unprecedented events. Many investors on all sides have experienced losses. I am here today to share my personal experience and to be helpful in this conversation.

Plotkin then goes on to deny the claims that Citadel bailed them out, instead insisting that their cash injection was simply a proactive investment.

Melvin Capital was not “bailed out” in the midst of these events. Citadel proactively reached out to become a new investor, similar to the investments others make in our fund.

The cherry on top here is Gabe admitting that the extent of their fundamentals on shorting GameStop is that selling video games in physical stores is being overtaken. I’m surprised he didn’t just say it’s the next Blockbuster.

In fact, we had been short GameStop since Melvin’s inception six years earlier because we believed and still believe that its business model – selling new and used video games in physical stores – is being overtaken.

If your short position was based upon physical stores being an outdated business model, why would you not close your position upon Ryan Cohen, the man who beat Amazon at e-commerce with Chewy, purchasing 9% of the company? What about when RC Ventures sent a letter to the board urging a digital transition, and hired an attorney specializing in hostile takeovers? What about when Cohen increased his stake? When the news released that Cohen and his Chewy team had been awarded 3 seats on the board, why not close the position then Gabe?

Greed. That’s why.

Read the full testimony here on house.gov