Hey GMEdd family,

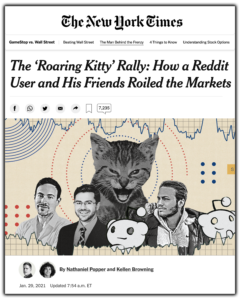

We’re so thankful for all the feedback we’ve gotten and the way the community has rallied around GME. While Friday’s close was above the fair market value of our bull case, we advocate for active price discovery by all market participants.

As it’s become clear that some participants are being excluded from the market – which breaks every norm of free & fair exchange upon which our society is built – we wanted to highlight some other community sites that have spun up to cover other elements of the GME story:

- wherecanibuygme.com – Pretty straightforward. Real time blogging covering the few retail brokers that have not betrayed their customers and are maintaining a commitment to free markets.

- isthesqueezesquoze.com – Daily updates on short interest and share availability, and a narrative of recent events.

- welikethestock.com – Do you like the stock? We like the stock.

Happy Sunday, and may happiness & profit find us all everyday.